Similar to the way it sounds, a bi-monthly mortgage is paid every two weeks instead of once a month. One-half of the monthly payment is paid during these two payments, so instead of 12 payments per year, you end up making 26 installments per year. At the end of the year, this equates to making one extra mortgage payment per month, which deducts directly from the principal balance of your mortgage.

Is this a good thing, a bad thing or neutral?

The Good, Bad and Ugly of Bi-monthly Payments

Bi-monthly mortgage payments can reduce your principal mortgage balance faster. And, yes, bi-monthly mortgage payments can shorten the term of your loan. Bi-monthly payments can even save you money in interest in the long run. Whether or not this option is good, bad or ugly depends on several factors, but the biggest factor is how your mortgage company handles the payments. Typically, you cannot take upon yourself to set up your own bi-monthly mortgage payment schedule. The mortgage servicing company probably has a bi-monthly payment option, but it’s going to cost you to establish it.

Generally, this fee tends to outweigh the benefit, which means it may not be worth it you’re your company does not charge a pre-payment penalty and allows you to pay every two weeks instead of monthly, then you can take advantage of the benefits of a bi-monthly program you set up for yourself. Another option, if you can afford it, is to place 50% of your mortgage payment into a special bank account each time you get paid. When your mortgage payment is due, use all of the money in the “mortgage bank account” to make a mortgage payment. If you get paid on a weekly basis then this equates to one extra payment a month or 12 extra payments a year.

Before you establish your own bi-monthly mortgage payment program, check with your mortgage lender to see if they offer a bi-monthly payment options and if there are any fees associated with it. If they do not have a program, inquire as to whether or not you can pay twice a month instead of once a month and see if there are any pre-payment fees for reducing your principal mortgage balance early.

Once you have the answers to these questions, you can truly assess if a bi-monthly mortgage payment option is good, bad or ugly for your personal financial situation.

Thursday, December 17, 2009

Bi-monthly Mortgage Payments: What You Need to Know

Posted by Kristie Lorette at 6:45 PM 0 comments

Labels: bi-monthly mortgage payments

Wednesday, December 16, 2009

Financial Help Resources You Want on Your Side

If you've become a victim of identity theft, the Identity Theft Resource Center provides free victim assistance. You can also give them a call at 1.888.400.5530.

If you suspect or are a victim of mortgage fraud, contact Freddie Mac or NeighborWorks America for information on predatory lending.

Before you decide to work with a financial advisor or investment broker, do a broker background check first with the Financial Industry Regulatory Authority or call 1.800.289-9999.

Posted by Kristie Lorette at 1:16 PM 0 comments

Labels: resource for identity theft, resources for financial broker background checks, resources for mortgage fraud

Tuesday, December 15, 2009

Technology Can be Hazardous to Your Credit Health

According to the Federal Trade Commission, more than 9 million Americans each year are victims of identity theft. The ease of technology adds to the hazard because once the thieves get a hold of your information, they can quickly and easily go online and apply for new credit in your name.

4 Ways to Protect Credit Online

* Never give out your social security number unless you know who you're providing it to

* Only shop secure websites where your information is encrypted

* If a company calls you on the phone asking for personal information, tell them you'll call back. Then hang up, find the phone number listed for the creditor and call back. Scammers try to identify themselves as one of your creditors in order to get information from you they can use.

* When you receive an email from a creditor asking for personal information, rather than click on a link in the email, type the web address in yourself. This helps you avoid providing personal information on a phishing website.

Posted by Kristie Lorette at 4:30 AM 0 comments

Labels: avoid identity theft, how to protect credit, how to protect personal information, protecting your credit

Wednesday, December 9, 2009

Tips for Getting Good Advice on Home Loans

Whether you’re a first time buyer or an old pro, there are always things you can learn to be a better shopper for home loans. There are various sources you can turn to for professional advice such as mortgage lenders, banks and mortgage brokers. The thing is you should be educated enough on your own to know right from wrong before relying solely on the advice someone else gives you.

Especially with the recent problems the lending market has faced, it’s more important than ever to be a savvy home loan shopper. Being in the know helps you to avoid being scammed or misled by professionals in the industry that may have lost their scruples.

Where to Turn for Professional Advice

• Real estate attorney: While hiring a real estate attorney to represent you in a real estate purchase does cost you, it tends to be well worth the investment. The attorney, paid by you, typically works with your best interest in mind and can help you to finalize financing that is beneficial for you and your personal financial situation.

• Recommended mortgage brokers: There are a multitude of talented and professional mortgage brokers in this country. There are also some predators that are more interested in churning a commission than they are about what’s best for you. If you choose to work with a mortgage broker, get a recommendation from friends, family members and co-workers that have used a broker to buy or refinance a property. People only recommend those they’ve had a positive experience with, so it reduces your chances of being on the losing end.

• Bank you have a relationship with: Chances are good that you have an existing banking relationship. Most banks also provide mortgages and home loans. An existing relationship can work to your advantage—helping you get approved faster and with better terms and prevent you from being scammed on your mortgage financing.

Posted by Kristie Lorette at 12:16 PM 0 comments

Tuesday, December 8, 2009

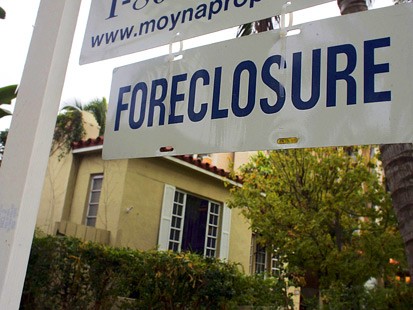

Foreclosure Buyers Beware: Don’t Buy at Auctions

Foreclosure rates are at an all-time high and many real estate investors are using this an opportunity to buy properties at bargain pricing. While buying low and selling at a point in the future for a higher price can be a reality, it's not something the novice real estate investor should necessarily consider. If you're an uneducated buyer, foreclosure properties can become a money pit and eventually wind up damaging your credit and your finances.

Unless you're a huge risk-taker, don't buy foreclosure properties at auctions. Foreclosure properties that are auctioned off to the highest bidder may come with liens and other legal headaches that make it less of a money maker and more of a trauma. If you're considering the purchase of a foreclosure, then buy directly from the bank holding the foreclosure instead.

Also, get financing for the purchase of the property before you start your shopping expedition. Many mortgage lenders offer mortgage pre-qualification, where you're pre-approved for a mortgage without having a specific property in mind. This can be a bargaining tool with the bank or it can put you at the head of the list over other buyers that do not have their financing in order.

Posted by Kristie Lorette at 1:06 PM 0 comments

Friday, December 4, 2009

Bad Credit and Your Mortgage

When it comes to obtaining a mortgage for the purchase or refinance of a piece of real estate, one of the primary factors that plays a role in the approval of the mortgage is your credit score. This doesn’t mean that bad credit borrowers cannot obtain a loan, but it’s going to more difficult and come with less favorable terms than a mortgage for good credit borrowers.

What is a Bad Credit Rating?

The recent collapse of the mortgage industry has changed the landscape of credit scores. What was once considered to be a high credit score, in the low 700s, is now considered to only be mediocre at best. Your credit is calculated using several different factors, which includes your payment history, the type of credit you have, the longevity of your credit accounts and possessing the right mixture of a variety of credit accounts (credit cards, mortgages, auto loans, student loans, store credit accounts, etc.). In today’s mortgage arena, lenders want to see a borrower with a credit score of at least 740 to be considered a great credit borrower. Below 740 to about 720 is considered good and anything falling below this is considered a bad credit rating.

Getting a Mortgage with Bad Credit

When you have bad credit, but a lender approves you for a mortgage, it usually comes with higher interests rate (anywhere from two and five percent higher than the interest rate for good credit borrowers). On top of this, traditional mortgages such as fixed rate mortgages may not be an option. Some lenders offer less favorable terms to bad credit borrowers, so you may wind up with an adjustable rate mortgage and a variable monthly payment.

How to Fix Bad Credit

If you have bad credit that is your fault—meaning you make late payments or do not make your payments at all—then the primary step for improving your credit score is to make all of your bill payments on time.

If your credit score is low but you’re not sure what’s causing it, or if you don’t know what your credit score is, then you need to order a copy of your credit report and credit score from each of the three credit agencies (TransUnion, Experian and Equifax). Review these reports carefully for negative items. If the negative items are not yours, then follow the dispute process instructions for each agency to remove the negative activity.

If the negative items do belong to you, then contact the creditors and collection agencies you have negative items with to see if you make payment arrangements or some other arrangements to take care of the debt. If and when the creditor agrees to an arrangement, be sure to obtain the agreement in writing. Also, be sure to stick to your end of the deal. Over time, these efforts will increase your credit score and make it easier and more affordable to obtain a mortgage.

Posted by Kristie Lorette at 10:27 AM 0 comments

Labels: bad credit and mortgages, bad credit mortgages, getting a mortgage with bad credit, how to fix credit for mortgages

Wednesday, December 2, 2009

Business Credit Cards & Your Personal FICO Score

There are situations where your employer pays your business credit card bills, but what happens if your employer makes late payments? How does this affect your personal FICO score? As you probably know, a few late payments can adversely affect your credit score. It’s one thing if you’re the one making the late payments. When it’s out of your control, then what?

According to Fair Isaac Corporation (FICO), late payments on your company issued credit card can adversely affect your credit score in the same way late payments on personal credit cards can. It all depends on whether or not the credit card issuer required personal information to apply for and get approval for the corporate credit card.

As you should be pulling and monitoring your credit reports once or twice a year anyway, be sure to check for the corporate card on your credit reports. If the corporate credit card is listed as one of your accounts on your credit reports, then late payments are being reported, which means your credit score may be in harm’s way. If the corporate credit card is not listed, then the activity for this card is NOT being reported to the credit agencies on a monthly basis.

Posted by Kristie Lorette at 7:19 AM 0 comments

Labels: corporate credit cards, FICO, small business credit cards

Thursday, November 26, 2009

Wednesday, November 25, 2009

Government Money to Reduce Credit Card Debt

When the Obama administration took over, one of its main initiatives was to help put the economy back on stable ground. Strategies for accomplishing this goal included the establishment of grants to help Americans get out of credit card debt. The overall American economy is made up of many parts, but when individuals and families are on steady ground, it contributes to the good of the overall economy. Find out how grants work and how these funding sources may help you to get out of the debt you are in.

Finding a Grant

The first step, and probably the trickiest part for most people, is knowing where and how to find a government grant to pay off debt. Start by contacting your county government, local associations and local organizations to find out what grants are available and for what purposes. The U.S. Department of Health and Human Services helps manage Grants.gov, a site providing information on a wide variety of federal government grants (see Resources).

Applying for the Grant

Grant applications can be long, labor intensive and tedious. When you obtain information on a grant you are interested in applying for, be sure to read the requirements carefully to make sure that you are eligible to apply. Once you pass the eligibility test, follow the instructions for completing the grant application very carefully and line by line. Grant application review committees tend to be sticklers when it comes to awarding grant money, which means it’s imperative that you complete the application completely and correctly. It’s also important to know the deadline of the grant application. Depending on the deadline, you may have a limited amount of time to complete what can be an arduous process.

Types of Grants

While most grants are not earmarked specifically to help you get out of debt, you may be able to find grants based on a personal need, business need, ethnicity, religion and more. You can also look to local organizations and associations. These organizations receive money from the federal and local governments to fund specific projects or support specific initiatives.

Debt Consolidation

While you probably won’t locate a grant with the title “Grant for Debt Consolidation,” you may be able to locate available government money based on how you got into credit debt in the first place. For example, if you funded the opening of an art gallery and backed a local artist and this is what put you in credit card debt, then the local art council may offer grants for local art projects. While some grants require that you apply for the grant before funding the project, other grants will allow you to pay in reverse order—you pay first and pay off the debt with grant money later. You’ll only be able to pay off expenses directly related to the project and you will have to provide evidence of what you spent and what the outcome of the spending was, but it is a way to use grant money to consolidate existing debt.

Tips

Register on websites such as Grants.gov to find and apply for possible grants. You can signup to receive email announcements when new grants are added to the database. this helps to ensure you meet the grant application deadlines.

Posted by Kristie Lorette at 9:17 AM 0 comments

Labels: credit card debt, government grants, reduce debt

Thursday, November 19, 2009

10 Steps to Financial Recovery

Getting control of your finances is within your reach Take these ten proactive steps to get yourself on the road to financial recovery.

1. Budget and save

Systematically add funds to a savings or emergency fund. Whether it's 10% each paycheck or $100 per month, automatically put a certain amount of money into a savings vehicle and forget you have it unless an emergency arises.

2. Cut spending

There are a multitude of ways you can cut back on expenses. It may require big cutbacks such as downsizing to a smaller and less expensive place to live or taking on a roommate, or less drastic costs such as buying ground beef instead of steak at the grocery store.

3. Track spending

Write down everything you spend money on. It's easy to see how much you're spending and where you're spending your money when it's all in writing. This is a quick and easy way to identify where you're overspending and cut back and cut out unnecessary spending.

4. Set goals

Set some short and long-term financial goals. Start with small goals you can accomplish such as paying off the $1,000 credit card balance you have. Work up into bigger financial goals such as having all of your credit card debt paid off in five years or less.

5. Earn more

There are plenty of ways you can earn some extra money. Take on a second part-time job, work from home freelance writing on the side or start a business selling your craft item. Use all of this extra cash to pay down and get rid of your outstanding debt such as credit cards. It's amazing how quickly this can help you gain control of your finances again.

6. Pay off bad and high interest debt first

Bad debt and high interest rates typically go hand-in-hand. Concentrate on paying off this debt first.

7. Check your credit score

Credit scores of 720 and higher typically bring borrowers lower interest rates and better terms on loans. Find out what your credit score is and if it's low, take some steps to improve it.

8. Dispute and correct credit errors

If there are items that are incorrect or do not belong to you, it may be bringing your credit score down. Work with the credit agencies to dispute any erroneous items and it can improve your score.

9. Use automatic payments

Pay your bills online or setup your bills for automatic payments. It ensures your bills are always paid on time, which reduces late fees and improves your credit score.

10. Do financial check-ups

Set a schedule once a quarter or a couple times a year where you check on your financial situation and make repairs and fixes where needed.

Posted by Kristie Lorette at 4:35 PM 0 comments

Saturday, November 14, 2009

The Psychology of Spending Money

A report released by the Journal of Experimental Psychology reveals people tend to spend less when:

1. Paying in cash rather than using a credit card or gift card

2. Carrying bigger bills such as $20s, $50s or $100s rather than $1s, $5s and $10s

So the moral of the story is pay in cash but carry big bills.

Posted by Kristie Lorette at 3:43 PM 0 comments

Thursday, November 12, 2009

How to Leverage Real Estate Equity

Some homeowners turn to the equity they have built up in their home as leverage for other purposes. Some of the common ways homeowners leverage their equity funds is by obtaining a home equity loan. A home equity loan allows homeowners to pull out the equity they have built in the home, which is the difference between the current value of the home and the balance of their existing mortgage.

Read the full story

Posted by Kristie Lorette at 8:29 AM 0 comments

Labels: how to leverage real estate equity, how to use real estate equity

Tuesday, November 10, 2009

3-step Approach to Refinancing Your Home

Especially at a time when interest rates are low, refinancing your home loan can be beneficial to your financial situation by saving you hundreds of dollars on your mortgage payment each month. Refinancing a mortgage is a process though—a process that can be tedious and frustrating at times. Before you sign your refinance mortgage application, take this 3-step approach to refinancing and make sure that it’s the right move for you and that you approach the process in the right way.

Start with your current mortgage lender. The most logical place to start with your refinance investigation is to start with your existing mortgage lender. Since you have an existing relationship with the lender, it may be faster and easier to refinance with them. First, the cost of refinancing (closing costs) may be reduced, depending on how old your loan is. Credit report checks, escrows and appraisals may all be waived if your loan is less than two years old an you have a positive payment record with the lender (always make your payments on time). The existing relationship may also equate to a lower interest rate than borrowing from a lender you don’t currently have a relationship—especially if it means they may lose your business to a competitor.

Compare current lender with other lenders. Shopping for the best deal does not only occur on car dealership lots and the local mall. Refinancing a mortgage is a major financial decision and you need to shop and compare at least three other mortgage lenders to your current lender. It’s almost a guarantee that if you shop four different lenders, you’ll walk away with four different closing costs, interest rates and annual percentage rates.

Once you have your facts and figures together, it’s important to compare the right items to each other before deciding the offer is the right one for you. Many refinance shoppers find the lowest interest rate and decide this is the lender offering them the best deal. This, however, may not be the case. The number you really should be comparing is the annual percentage rate (APR). the APR is the annualized cost of credit, so it give you a true picture of how much the refinance is costing you because it includes the closing costs in the percentage rate.

After comparing the APR, it’s also important to compare the terms and conditions of the new loan. For example, you can’t really compare a 30-year fixed rate mortgage to a 15-year and say that one lender is better than the other. You need to compare lenders based on the same types of mortgages.

Apply for the mortgage refinance. Once you have chosen the lender, the next step is submitting your mortgage application and any supporting documents the lender needs to process you application. Most mortgage companies have stepped into the 21st century so you can speed up the application process by submitting everything online from the comfort of your own home or office. Even if you don’t complete the application yourself, the loan officer you’re talking to on the phone is submitting the information into her computer and everything is done electronically. This also opens up your lender options so that you’re not bound by geography. Expect a mortgage application processing time of anywhere from three to six weeks from the time you submit the application until the time you close on the mortgage refinance

Interest rates are low, so refinancing your home loan may be on your list of things to do before the end of the year. When you chunk the mortgage process down into these three easy steps, it can be a faster, easier and more beneficial way to refinance your home, save you money and make your overall financial situation a little bit brighter.

Posted by Kristie Lorette at 6:51 AM 0 comments

Labels: how to refinance a mortgage, steps to refinance a home loan, steps to refinancing

Thursday, November 5, 2009

How to Become an Affiliate for Loan Modification Company

Looking for a revenue stream for your mortgage website or a way to make money online?

Check it out now

Posted by Kristie Lorette at 7:40 AM 0 comments

Labels: how to become a loan modification affiliate, loan modification affiliate program

Wednesday, November 4, 2009

How to Invest in Real Estate Using Your 401k

Are you interested in purchasing real estate but don’t have the immediate capital to make the investment? Have you begun planning for retirement by opening a 401k? If the answer to both questions is “yes,” you might be in luck. Consider using the capital of your 401k to invest in the real estate by borrowing against the retirement account to fund the real estate loan. Any investment includes some risk, but with careful planning you will be on your way to utilizing the money that is sitting in a retirement account and profiting from a wise real estate investment.

Step 1: Assess the value and rules of your 401k. The amount of your loan will be based on the value in your retirement account, and while the 401k provides guaranteed funds, you will still be unable to borrow more than you can be expected to pay back. Additionally, your 401k might have rules that make borrowing against it difficult or subject to certain conditions. Be sure to check on this before beginning the process of acquiring a loan against the account.

Step 2: Research the different options available for investing in real estate using a 401k. One of the safest options is the real estate investment trust (REIT), which is composed of other companies that purchase and dispose of property. By investing in the REIT, the investor is allowing others to make the actual real estate investment, and while limits the investor to the decisions of others it also takes some of the load off the investor’s back.

Step 3: Research the option of the individual retirement account (IRA) for your investment. The IRA is not always a feasible option for some holders of a 401k, but it is something to consider when planning for a real estate investment with a 401k. Bear in mind that relocating money from the 401k to the IRA could impose a financial penalty, and this might or might not be worth the cost for your investment.

Step 4: If you are planning to use a loan for your investment, research and select a lender. With a conventional loan, you are essentially borrowing against yourself and ultimately pay yourself back with the loan. But this is considered a valid option for the 401k, so be sure to look into it closely. Each lender will have different rules for this type of investment, so ask around, and be sure to check on the specific requirements of the lender. Fees, interest rates, and so forth will vary, and these can have a significant impact on the value of the investment.

Step 5: Select the type of investment that you will use. Be sure that you have consulted a financial advisor, and particularly one that is familiar with real estate investments before you make your ultimate decision.

Tips and Warnings:

Many investment professionals will advise against taking out a loan against the 401k, due to the inevitable risk that ensues. As a result, the REIT might be the only option, because it is usually considered the safest.

Posted by Kristie Lorette at 5:56 AM 0 comments

Labels: how to use a 401k to buy real estate, how to use a 401k to invest in real estate

Wednesday, October 28, 2009

The Truth about Credit Counseling Agencies

Credit counseling agencies, debt relief services, consumer credit help--these are but a few of the names that companies claiming to help consolidate consumer debt go by. As a former mortgage and credit specialist, I've had an up close and personal view of how consumers turning to these companies for help can also receive a big fat mortgage denial.

Why?

The answer is rather simple. A lender or a creditor gets an uneasy feeling when they see that you couldn't manage your finances on your own, but had to turn to a "credit counseling" agency to do it for you. Lenders would rather see that you took control of the situation yourself and took the steps necessary to get out of debt on your own.

The truth is that everything you can pay a credit counseling agency to do for you, you can do for yourself. Yes, it will take some of your time, but you put yourself in debt so it is your responsibility to get yourself out of it too.

Take Control

First, contact each of your creditors and lenders. Explain you're having problems paying your bills but you want to work out an arrangement that is mutually beneficial. Most companies would rather work out a payment arrangement than not get paid at all, so you may be surprised at how many of your creditors work with you.

Second, get all of your agreements in writing. Get the name and contact information for the person you speak with at each lender. Follow-up your phone call with a written description of the agreement. Most companies will send you something more formal via email or in the mail, but you need to be proactive about the situation and document everything.

Stick to it. Once you establish an arrangement with your creditors, make sure to hold up your end of the bargain by making the agreed upon payments and making them on time--always.

Credit counseling agencies saw a need (or more of an opportunity) in the market to make money and they took it. Working with a credit counseling agency can solve your debt problems in the short-term, but can be damaging to your ability to obtain new credit in the future and in the long-term. Avoid this problem by acting as your own credit counselor. It resolves your debt problems and shows creditors and lenders that you are in full control of your finances and you have the ability to manage your own finances.

Posted by Kristie Lorette at 8:51 AM 0 comments

Labels: credit counseling agencies, credit counseling service, debt relief companies

Tuesday, October 27, 2009

When a Fixed Rate Mortgage is the Best Option

Mortgages are not one-size-fits all financing options. The type of mortgage that is right for your neighbor may be disastrous for your personal financial situation. Also, there is a major misconception that fixed rate mortgages are always the best option. Always is a strong term and there aren’t many things in this world that are “always.” The same is true with fixed rate mortgages.

So when is a fixed rate mortgage the way to go?

Personal Situation

The first aspect of your life you to need to review is your financial situation. Ask yourself the following questions to gain a better understanding of where you stand.

o How long will I realistically live in or own this home? No matter how many years you say, see if there is a mortgage that matches or comes to close to the number of years in your answer. For example, if you say five years then a mortgage fixed for five years may afford you a lower interest rate than a 30 year fixed.

o Do I live on a fixed income or will it stress me out if my monthly mortgage payment fluctuates? If you need to know exactly how much your monthly mortgage payment is going to be at all times or it stresses you out to think of your payment changing, then a fixed rate mortgage is the most beneficial one for you.

o Did I have my past mortgage(s) for the entire time I lived in the home or did I refinance or sell before the end of the mortgage? The national American average reveals that homes are refinanced or sold in five to seven years. This means that it’s rare, if not non-existent, to hold a mortgage for a 15 or 30 year period. So if you can get a lower interest rate and lower monthly mortgage payment with another type of fixed rate or variable rate mortgage then it may be worth looking into it.

Interest Rate Environment

The other major item you need to consider before deciding on a fixed rate mortgage is the current interest rate environment. If the current interest rates are low, then locking in on the low rate with a fixed rate mortgage probably is the best way to go. If interest rates are high and are expected to drop in the near future, then a fixed rate mortgage may not be the best option as part of your long-term strategy.

When is a fixed rate mortgage the best option? It depends on your personal financial situation, emotional state and current interest rates. Long-term and short-term considerations can also affect your decision, so keep all of these things in mind when choosing your next mortgage.

Posted by Kristie Lorette at 10:54 AM 0 comments

Labels: fixed rate versus adjustable rate mortgages, when a fixed rate mortgage is beneficial, when a fixed rate mortgage is right

Wednesday, October 21, 2009

5 Things to Do Before You Apply For a Mortgage

Applying for a mortgage, whether it's for a purchase or a refinance, is a major financial undertaking. It's a financial step that should be taken very seriously. You should also go into the process with your eyes wide open and with enough knowledge to understand what it is happening and you move through the mortgage process. Before you start submitting your mortgage application, there are some things you need to do to prepare for the process.

1. Decide on a mortgage amount. The amount you want or need to mortgage versus how much of a mortgage you can afford may be two different numbers. You need to have a realistic idea of the mortgage amount you can afford. One of easiest ways to figure out how much a mortgage payment is going to be based on the mortgage amount you want is to use a mortgage calculator or refinance calculator. You can input the amount of the mortgage and the current interest rate to see what the monthly payment comes out to be. You can then compare the monthly payment with your budget to sit if the two fit. You can continue to adjust the mortgage amount or type of mortgage to see how this changes the monthly payment until you create an affordable scenario.

2. Decide how long you'll live in the home. People often have the misconception that if the current interest rate is less than what they are paying now that they should run out and refinance. Since there are closing costs involved in a refinance, getting a lower interest rate may not be enough to truly save you money. In order to determine if you will recoup your closing costs in a refinance, you should do a break even analysis, which will tell you how long it will take you to recoup your closing costs. If you're planning on being in the home longer than it takes you to break even then it is usually beneficial to refinance.

3. Include the cost of homeowners insurance and taxes. You may be able to afford the monthly mortgage payment, but it's also important to consider the other costs involved in owning a home. Find out the estimated taxes and insurance for the home and be sure to add this cost to your monthly payment. This will provide a full cost view as to whether or not you can afford to buy a home.

4. Check your credit report. Especially during the economic downturn, a high credit score is more important than ever to get approved for a mortgage. Generally speaking, lenders are looking for credit score of 720 or higher. You'll want to get a copy of your credit report from each of the three credit agencies (TransUnion, Experian and Equifax) to make sure that all of the information is correct. If you find any incorrect information on your credit reports, correct it by contacting the agency or opening a dispute with the credit bureau reporting the negative information.

5. Get pre-approved. If you're purchasing a home, you may want to get pre-approved for a mortgage before you start house hunting. Not only will a pre-approval letter from a mortgage lender allow you to look at homes in your price range, but it may also be a bargaining tool for negotiating the purchase price of the home.

Applying for a mortgage, especially in today's economy, isn't always an easy task. You may be able to streamline the process by doing some preparation ahead of time. Before you apply for a mortgage, take a look at your financial situation and go through these seven steps to make sure that obtaining a purchase mortgage or refinancing your current one is a viable option for you.

Posted by Kristie Lorette at 8:03 AM 0 comments

Labels: pre-mortgage, steps to take before applying for a mortgage, what you need to do before applying for a mortgages

Tuesday, October 20, 2009

How to Become Mortgage Loan Officer

According to the Mortgage Banker's Association, approximately 99 percent of the homes purchased in the U.S. are financed with a mortgage. With such a demand for mortgages, becoming a mortgage loan officer may be a career option worth looking into.

Check job postings. The Bureau of Labor Statistics states that nine out ten loan officers in the United States work for institutions such as banks, credit unions and other related financial institutions such as mortgage lenders. Look at the websites for local banks in your area to see which career positions are available. You can also look at job posting websites such as Monster, CareerBuilder and Hot Jobs.

Qualification match. See how your experience and background lines up with the job requirements for the position you're interested in applying for. Typically, a loan office has a bachelor's degree in business, finance, economics or a related field. Experience working in a bank or for a lending institution can be beneficial, but is not always required. This type of experience may be substituted for the education requirements as well.

Licensure. Loan officers working in banks or credit unions typically are not required to obtain a mortgage broker license. Working as a loan officer for another type of institution may require you to obtain your mortgage broker license. It may be a state requirement where you'll be processing loans for you to obtain a license. Mortgage News Daily breaks down the licensing requirements by state, so you can follow the guidelines for the state you'll be working in if you need to obtain a license.

Salary range. Working as a mortgage loan officer can be a salaried position, a commission position or a combination of the two. Some institutions pay loan officers a salary based on experience. Other institutions pay for each mortgage file that the loan officer processes and closes. Finally, some companies pay the loan officer a salary (which is typically lower than a straight salaried loan officer) and then pay a commission for each mortgage file that is processed and closed.

Posted by Kristie Lorette at 12:33 PM 0 comments

Labels: how to become a loan officer, how to become a mortgage loan officer

Thursday, October 15, 2009

The Role of an Attorney in Your Home Purchase

As is the case with most major purchases, buying a home is a multistep process. It also typically requires the involvement of several different parties including your real estate agent, real estate attorney, mortgage lender, title company and more. By using professionals such as real estate agents and attorneys from the beginning of the process, you can save yourself from making mistakes that can cost you time and money in the end.

What a Real Estate Attorney Does

A real estate attorney can help you with a home purchase before you even start looking for a new home.

Some of the roles your attorney play include:

• Advising you on the best way for you take title of the home, financing issues that may arise and helping you to make the right decisions based on your overall financial picture

• Reviewing your purchase offer price and terms before you submit it to the seller

• Reviewing or drafting the purchase and sale agreement, the terms of the agreement and who will hold the deposit

• Providing you advice in terms of mortgage financing so that the purchase and sale terms of the contract can be tailored to fit your lender’s requirements

• Obtaining an abstract of title for the property from the seller

• Examining the abstract for title defects

• Establishing an escrow account

• Recording the legal documents in the public records and paying the applicable taxes and recording fees after the mortgage closes

• Issuing title policies upon receipt of the recorded documents

You wouldn’t build a house without consulting an architect and builder, so you shouldn’t enter into a home purchase without first consulting a real estate attorney. The knowledge and experience a real estate attorney has can save you from irreversible mistakes that can cost you money or kill a real estate deal completely.

Posted by Kristie Lorette at 10:39 AM 0 comments

Labels: real estate attorney, role of a real estate attorney

Wednesday, October 14, 2009

Understanding Homeowners Insurance

When you own a home, you’ll want to protect it from loss or damage with a homeowners insurance policy. In fact, if your home is financed, then the mortgage company probably requires you to carry a certain amount of coverage. There are different options for covering the loss of or damage to the home itself and coverage options against loss or damage to your personal property. Then there is personal liability insurance, which covers you if someone is injured on your property that can be added to your policy.

Types of Coverage

Dwelling coverage. This type of coverage provides you with the money you need to cover the cost of rebuilding your home, which includes the interior and exterior. The square footage of the home is used to calculate the amount of coverage you should carry. You may also want to inquire with your insurance carrier to see if the policy has guaranteed replacement cost, which covers the cost to rebuild your home, even if the costs exceeds your policy amount.

Personal property coverage. This type of coverage insures the contents of the home. Personal property coverage typically amounts to 50-75% of the amount of dwelling coverage.

Liability insurance. If someone is injured while on your property, this type of coverage helps you to cover their medical expenses and the legal fees of a lawsuit. The amount of the policy is usually double the amount your personal assets are worth.

Master policy. If you own a co-op or condo, a master insurance policy typically covers damage to or injuries incurred in the common areas of the complex such as the pool, roof, exercise facility and walkways. This policy does not protect individual tenants for damage to the interior of their units or their personal property. You can ask your association for the details on what the master policy covers, but dwelling, personal property and liability insurance for your is still necessary.

Types of damage usually covered by a homeowner’s insurance policy:

• Fire or lightning

• Explosion

• Windstorm or hail

• Aircraft or vehicle crash damage

• Smoke

• Theft

• Vandalism

• Volcanic eruption

• Snow, sleet, or ice weight damage

• Water or steam damage from an internal problem like a plumbing, heating, air conditioning, or automatic fire-protective sprinkler system, or from a household appliance leak

Buying a Policy

You can do some online comparison on policies or contact your insurance agent for more information on homeowner policies. Since insurance needs vary by the person, you should base your needs on your personal situation rather than what a neighbor, family member or friend has. Organizations such as the Insurance Information Institute (www.iii.org) offer more information and resources on homeowner policies.

Posted by Kristie Lorette at 11:19 AM 0 comments

Labels: homeowner insurance, homeowner's insurance

Tuesday, October 13, 2009

5 Ways to Earn Money and Get Out of Debt

When you are burdened with debt, it can make you feel like you are trapped under a heavy weight. Debt can wreak havoc on your life and even your health--causing stress, loss of sleep and loss of an appetite to name but a few side effects. One of the easiest ways to get out of debt is to increase your income and here are five ways you can earn some extra money. Focus on applying all of the extra money you earn to paying down your debt. You'll be amazed at how quickly you can earn extra money to get out of debt.

1. Sell your stuff online. While sites such as ebay may charge you a small fee to sell items online, there are other classified sites such as Craigslist where you can list items for sale for free. It's like having a virtual garage sale where you sell items you no longer want or need. Depending on what you have to sell, virtual garage sales can rake in some big bucks.

2. Sell what you grow. If you have a green thumb and grow beautiful flowers or delicious fruits and vegetables, turn it into a moneymaker. Sell at the local farmer's market, flea market or if your town permits on the side of the road. Even selling your goods on the weekends may provide you with enough extra income to take a big chunk out of the amount you owe.

3. Have a garage or yard sale. While selling your stuff online allows you to reach a wider audience, a one or two day garage sale can attract quite a gathering of locals. How much you make can vary, but it's not unheard of to rake in a couple hundred bucks or more from a decent size garage sale.

4. Babysit. Offer babysitting services to friends, family members and neighbors. This is an easy way to rake in $10-$20 an hour without ever having to leave the comfort of your own home.

5. Sell your crafts. If you're creative or artsy, you can also turn your hobby into a side business to earn extra income. Whether you make handmade greeting cards and invitations or furniture and jewelery, there are craft markets where you can list items for sale online. You can also build and sell from your own website or attend local craft fairs and church bazaars.

Posted by Kristie Lorette at 11:26 AM 0 comments

Labels: how to earn extra money, how to get out of debt, ways to earn extra money to get out debt

Thursday, October 8, 2009

Is Investing in Real Estate Still Wise?

With a tumultuous housing market and economy as a whole, you may be wondering if real estate is still a good investment. As part of a long-term investment strategy it is still an investment that is considered to build wealth. The dip in the price of homes and other pieces of real estate may mean that you have the opportunity to earn an even greater return. Because you can buy real estate now at bargain pricing, you may be able to earn more of a profit when you sell it later, when the real estate market returns to normal.

Fellow finance writer Rayce Banner answers the question, "Is Real Estate Investing Still Evergreen?"

Investing in real estate is another time-tested method for building wealth. Over the generations, real estate owners and investors have enjoyed rates of return, comparable to the stock market. The best place to start with real estate ownership is to buy your own home. The equity, which is the difference between the market value of the home and the loan owed on it, in your home that builds over the years can become a significant part of your net worth. Among other things, this equity can be tapped to help finance other important financial goals such as retirement, college and starting or buying a business.

In addition to building wealth through home ownership, you can also consider investing in real estate that you rent out, often referred to as investment property. If you wish to invest directly in real estate, residential housing (such as single-family homes or small multiunit buildings) is a straightforward and attractive investment for most people.

Before you venture into real estate investing, be sure that you have sufficient time to devote to it. Also be careful not to sacrifice contributions to taxdeductible retirement accounts in order to own investment real estate.In the early years of rental property ownership, many investors find that their property's expenses exceed its income. This "negative cash flow" can siphon off money that you could otherwise direct into your retirement accounts to earn tax benefits. When selecting real estate for investment purposes, remember that local economic growth is the fuel for demand for housing.

In addition to a vibrant and diverse job base, a limited supply of both housing and land on which to build is another factor that you should take into consideration. When you identify potential properties in which you might invest, run the numbers to understand the cash demands of owning the property and the likely profitability.

If you don't desire to be a landlord (one of the biggest drawbacks of investment real estate) consider investing in real estate through real estateinvestment trusts. REITs are diversified real estate investment companies that purchase and manage rental real estate for investors. You can invest in REITs either through purchasing them directly on the major stock exchanges or through a real estate mutual fund that invests in numerous REITs. Because REITs tend to pay fairly healthy dividends, it's best to avoid investing in them outside of tax-sheltered retirement accounts during your working years or if you're in a high tax bracket.

Most diversified U.S. stock mutual funds invest a small portion of their assets in REITs. If you'd like REIT-focused mutual funds, among better such funds are Fidelity Real Estate, Cohen & Steers Realty Shares and Vanguard REIT Index.

Rayce Banner is a freelance writer on financial topics. Check out the learning "game" that has had a huge positive impact on his career direction: http://www.best-online-golf-game.com/cash-flow-game.html.

Posted by Kristie Lorette at 1:51 PM 0 comments

Labels: investing in real estate

Wednesday, October 7, 2009

Teach Your Kids about Adult Bills

In the final tip about teaching your kids how to be responsible money managers, you'll learn how to give your kids a realistic view of bills. Bills are a fact of life and now is the time to teach them what their future holds when it comes to expenses.

The easiest way to do it is to open bills when they come in the mail or hit your inbox. Sit down with your child and make a list of the monthly household bills. This helps them to gain perspective on what things cost and how much they can expect to pay for things when they become adults. You can use this as a guide to teach older children how to create a budget.

Posted by Kristie Lorette at 4:52 PM 0 comments

Labels: teach your kids about money, teaching kids about managing money, teaching kids about money

Teach Your Kids about Investing

In spite of what has taken place in the history of the stock market, investing today for tomorrow is an important lesson to teach your children. The point can easily be illustrated by taking them to open their own ROTH IRA account when they start to earn money of their own.

You can illustrate the same point by sharing your own retirment accounts or that of your spouse. If you have a 401k or IRA of your own, explain to your child how investing works, where the money comes from that goes into the accoun and how the money grows and changes over time.

Posted by Kristie Lorette at 9:48 AM 0 comments

Labels: how to teach kids about money, teach kids about investing

Tuesday, October 6, 2009

Consolidation Definition

The term consolidation has several different meanings, depending on the context in which it is used. Consolidation may be used in the business or corporate world or it may be used to refer to a financial situation.

Business

As a business term, the term consolidation is used to describe a situation in which two different companies, lines of business such as product lines or different areas of the company become one. This is different from a merger, Which is when a new business is formed when the two businesses come together. In a consolidation, one company is left standing. Examples are the 1999 takeover of Nabisco by Kraft Foods and the acquisition of Best Foods by Unilever.

Shakeout

In a mature business market, consolidation is the process of natural selection in which successful businesses grow bigger and begin to acquire smaller businesses. In the process, this also shuts down some smaller companies. In the end, this leaves only the strongest and biggest of the companies left standing. The consolidation process is also referred to as a shakeout.

This is exactly what happened in September 2008 when bank failures hit the news on a daily basis. Merrill Lynch was soon acquired by Bank of America, which did away with Merrill Lynch but left Bank of America standing as a financial giant.

Debt

When referring to debts, consolidation is the term used when several loans are replaced with one single loan. When this occurs, it usually creates a lower loan payment and a longer loan term.

Some consumers use debt consolidation companies to assist them in working with their creditors to turn several loans or credit accounts into one loan or credit account and one monthly payment. Typically, this includes paying a lower interest rate on the consolidated loan than what the consumer was paying for each loan individually.

Other consumers take out a new loan (such as an equity line of credit) to pay off and consolidate higher interest rate debt (such as credit cards). This type of consolidation helps the consumer to pay less interest in the long run and turn several loans or credit accounts into one loan and payment.

British Government

In Britain, this is also the term given to the process of combining two or more acts, bills or statutes before they are presented to Parliament. This typically occurs for legislation that is related in some way so that it makes sense to combine two or more pieces into one.

Posted by Kristie Lorette at 5:39 PM 0 comments

Labels: consolidation, definition of consolidation, the meanings of consolidation

Thursday, October 1, 2009

Teach Your Children about Money Tip #5

Tip #5 for teaching your child about money involves teaching them how to bail themselves out of financial jams. It may be hard to resist the urge to help bailout your child, but when you don't always come to their rescue, your child learns to save themselves. So if your child wants to buy an expensive toy or item, have them take a good look at the amount of money they have in their own account. If they do not have enough money to buy the item then do not give a cash advance to your child so they can buy the item. Instead, brainstorm with your child to see what ways they may be able to come up with the extra money they want to buy the item.

For college aged children that run up their credit cards, do not offer to pay them off. Again, spend some time talking with your child to see how she can come up with the extra money needed to pay off the credit card bill. These types of lessons teach your children that they have to work for their money and manage their debt themselves because there isn't always going to be somebody (like Mom and Dad) to bail them out all the time.

Wednesday, September 30, 2009

Day #4 Teaching Your Child about Money

Financial obligations are a commitment and it's important to drive this point home to your children. Mother of four, Alicia Vargo, could not have driven this point home even better with her four children (ages 16, 17, 19 and 21).

"I have always made certain that if anything were to ever happen to me that they would know how to take care of themselves. Examples of this are each one of them saved for their cars, we matched down payments, but we put the cars mainly in their names so they could build their credit, pay their car payments and their insurance," says Alicia.

Alicia and her husband have downsized significantly in their "things" as an example for the kids in being financially responsible while maintaining quality of life. Alicia and her husband have tried to teach their children not live for their mortgages, but rather to purchase a home they can afford to pay for each month. Circumstances in life can and do change quickly, so teach your child to have a realistic view of what quality of life means and that bigger isn't always better.

Alicia's daughters are 19 and 21 and already have a substantial and positive credit history, strong savings accounts, and can rent an apartment or house on their credit alone.

Alicia states, "We have taught them how to pay their bills and build their credit."

It just goes to show that no matter what age you start, it's imperative to teach your children that when they use a credit card, take out a car loan or use a mortgage to buy a home that they are responsible for making the payments--each and every month--so they need to make wise purchase decisions and buy what they can afford to pay for.

Posted by Kristie Lorette at 12:55 PM 0 comments

Labels: creating financially responsible kids and adults, financial obligations, teaching kids about money

Tuesday, September 29, 2009

Is Credit Card Counseling the Way to Go?

Especially if you are in credit card debt, you may have heard of or investigated working with a credit card counseling agency. A credit card counseling agency helps consumers to consolidate their credit card debt, lower their monthly payments and make it more affordable for credit card holders to pay off their debt. These counseling agencies negotiate with your credit card companies for you to make this happen, but is it worth it to work with a credit counseling agency to get your debt under control?

The cold hard truth is that it may not be worth it at all.

First of all, it can damage your credit, which may sound like the direct opposite of what you would expect. Using a credit counseling agency to help you consolidate your debt is the equivalent to writing your future creditors a letter stating that you are financially irresponsible and can't manage your own money. Therefore, you have to turn to professionals for help in getting your finances in order. This means that it can harm your chances of obtaining credit in the future when creditors see that you had to turn to a credit counselor for help in the past.

Second, you don't need a credit counseling agency to negotiate better rates on your credit accounts or to consolidate debts. These are steps you can take on your own. Call each of your creditors, explain your situation or financial challenge and see what they may be willing to do. Most creditors would rather work out an arrangement with you than not get paid at all.

So before you throw up your hands in defeat and turn everything over to a credit counseling agency, be sure to measure some of the disadvantages of working with this type of agency. Once you take a look at both sides of working with an agency, then decide if it's still something you want to pursue or if it's something you can handle on your own.

Posted by Kristie Lorette at 10:37 AM 0 comments

Labels: credit counseling, credit counseling agencies, credit counseling agency

Wednesday, September 23, 2009

Teach Your Child Amount Money by Limiting their Access to It

It's Day #3 on how to teach your kids what they need to know about being responsible managers of their money. No matter how wealthy or poor your family is, the only way to teach your children how to budget and manage money the right way is by limiting how much money you give to them. This is not an encouragement to let your child suffer. It's fine to give your child an allowance in exchange for doing household chores or completing tasks, but make sure that the payment fits the duties.

This helps children to learn how to save and spend their money according to how much they have. If the latest video game has hit stores and your son is saving up his allowance to buy it, then he knows he has to forgo buying a shirt he wants and hitting Starbucks everyday with his friends after school for an iced latte. Otherwise, he won't have enough money to buy the game.

Providing an allowance to college-age children is OK too, but you'll better prepare them for adulthood by keeping this amount within meager means as well. When they hit the real world, they are going to have to start at an entry-level job, probably not making a ton of money. They need to learn how to live within their means and by not overindulging them, you're preparing them for their financial future.

Posted by Kristie Lorette at 12:33 PM 0 comments

Labels: teach kids how to be financially responsible, teach kids how to budget, teach kids how to manage money

Tuesday, September 22, 2009

Teach Your Child about Budgeting

Today it's time for Tip #2 about how to teach your children about money. The old adage, "Money doesn't grow on trees," probably isn't enough to teach your children that money is a limited resource. Instead of giving them a visual of a money tree, share the family budget with them instead.

Depending on your child's age, you can accomplish this in a couple of different ways. With a set of jars and a pile of change, you can easily show small children how limited money can be. Label each jar with a sticky note or piece of paper that describes a household expense.

Some categories may include mortgage, food, electricity, water and clothing. Start out with a pile of money (can be bills, coins or even monopoly money in order to illustrate the point).

Tell the kids how much money in income you have every month and then go through expense by expense as you drop the money in the appropriate jars. At the end of the expenses list, explain the money that is left over can be used for other purchases such as going to the movies, on vacation or buying "extras" such as candy or other things your children enjoy.

Older children probably don't need the jar exercise, but sit down with a spreadsheet on the computer or a paper and pen list of income and household expenses. You can illustrate the same point--money is limited and "fun money" can only be spent after all of the necessities in life are paid for.

Posted by Kristie Lorette at 12:21 PM 0 comments

Friday, September 18, 2009

Teach Your Children about Personal Finance

If you've been paying attention over the past few years, then you know that your child's college savings plan doesn't have as much money as it used it. Maybe you or your spouse lost their job in the past year or two and you don't have enough money coming in to even cover the cost of saving for your child's education.

Whether or not it's about sending the kids off to college is irrelevant. It's more important to note that you have to teach them how to manage their personal finances. Unless, that is, you want them to live with you for the rest of your life. Since the answer to this is probably no, over the next few weeks I'll be running a series on how to teach your kids about personal finance so they can manage their own finances and become financially independent and responsible adults. Some of the tips may need to be modified slightly depending on how old your kids are, but the earlier you start teaching, the better it will be for them and for you.

Tip #1 Create a plan

The only way you can teach kids about managing their money is to make a plan that helps to guide them in money management. Children typically earn money in a couple of ways--chores, birthday and holiday money and a part-time job when they become teenagers. So instead of letting them spending every dollar they earn or receive as a gift, create a plan where some of the money has to be used to pay for one of their own expenses or put into a savings account that they are not allowed to use.

For example, a teenager may be required to pay for a portion of her car insurance payment or put gas in her car with her own money rather than money from Mom and Dad. Pre-teens may be required to put 10% of the gift money they receive in a savings account, mutual fund or stock. You can have them buy a fun stock such as Disney, which will even mail them a really cute stock certificate with Disney characters on it.

Child wants an expensive pair of designer jeans that are too much? Offer to pay for a certain portion of the jeans and then the child has to find a way to come up with the difference or they can't have the jeans. When the child has a vested interest in making a purchase, it helps them to appreciate the value of money better than when you buy everything for them.

Posted by Kristie Lorette at 8:04 AM 0 comments

Labels: how to teach kids to be financially responsible, teach children about money, teach kids about finances

Wednesday, September 16, 2009

Financial Knowledge is Power

It's no wonder the American economy is in the toilet. According to a recent survey conducted by the Center for Economic and Entrepreneurial Literacy:

1. Only 47 percent surveyed knew what the Dow Jones Industrial Average is

It's an index that measures the performance of stock for 30 American companies.

2. Fifty-seven percent knew that their credit score is the most important factor in whether or not they can get approved for a loan.

3. A mere 48 percent understood that one of the primary benefits of investing in an IRA is that the contributions are tax-deductible.

If you don't find yourself in the know about these and other important financial factors, then start reading articles and doing some of your own research to bone up on your finances. It may make the difference from having a healthy financial life or a miserable one.

Posted by Kristie Lorette at 11:25 AM 0 comments

Labels: financial health, financial knowledge, understanding finances

Tuesday, September 15, 2009

Loan Modifications: Helpful or Harmful?

Before the foreclosure rates started to reach an all-time high, many of you may not have even heard of a loan modification. Most mortgage borrowers think that establishing a mortgage is a binding contract (which it is) and that the only way to change your mortgage is to refinance it. For the most part this is true, but in extenuating circumstances and on a case-by-case basis you may be able to to modify your existing mortgage.

What is a loan modification?

A loan modification occurs when a lender agrees to modify an existing mortgage because a borrower can longer afford to pay on the mortgage. This is a long-term inability to pay because of an extenuating circumstance (loss of a job, huge interest rate and payment adjustment of an adjustable rate mortgage, death of the bread winner). A loan modification typically involves a decrease in the interest rate of the mortgage, a lower monthly payment, a change in the type of mortgage or an an extension in the term (or length) of the mortgage. A mortgage lender typically agrees to a loan modification because it's less expensive for them to modify the loan than it is to foreclose on the home.

It sounds good so far, right?

Where the Problems Creep In

While hundreds of thousands of homeowners heading down the foreclosure path have been saved by loan modifications, there are just as many that have been adversely affected by the loan modification process.

Some of the disadvantages that loan modification borrowers have experienced include higher mortgage payments and a higher balance due on the mortgage than before the modification. So how does this happen?

What many loan modification borrowers do not realize is that many lenders are rolling costs such as late fees, the amount of unpaid back taxes on the home and other administrative costs back into the balance of the mortgage. This is leaving some borrowers with a higher mortgage balance and monthly balance payment than before the modification, which is the direct opposite effect they were looking to achieve.

This is not always the case. There have been many borrowers that have come out ahead and saved their home with a loan modification. For example, 80% of the borrowers that modified their loans through Wells Fargo are now enjoying lower monthly mortgage payments than they were before the modification took place. At Citimortgage, 92% of its loan modification customers have benefited from a loan modification.

The moral of the story is that it could go either way. Mortgage modification is not the panacea to the foreclosure problem. You need to speak with your lender and make sure that you fully understand all of the terms, conditions and fees associated with a loan modification to make sure it puts you on the beneficial side of the equation.

Posted by Kristie Lorette at 11:22 AM 0 comments

Labels: loan modifications, mortgage modifications, the benefits of a loan modification, the disadvantages of a loan modification

Friday, September 11, 2009

Commercial Mortgage Defaults To Rise

Posted by Kristie Lorette at 1:18 PM 0 comments

Labels: commercial mortgages, commercial real estate market, defaults on commercial mortgages

Thursday, September 10, 2009

Are Commercial Mortgages Suffering Too?

I met with an old friend yesterday, who also happens to be a commercial real estate agent. He cried (not literally) that the commercial real estate market was feeling the ill effects of the economy too, so it got me to thinking, how are commercial mortgages fairing in this economy? Are commercial mortgage borrowers in the same dire straights as residential borrowers. Are foreclosures on commercial properties the same, lower or higher than residential properties?

According to Deutsche Bank, the increase in the unemployment rate and the increase of business failures has caused the number of defaults on commercial mortgages to rise. In fact, in the second quarter of 2009 the delinquency rate on commercial mortgages almost hit 3 percent and totaled $750 billion in delinquent debt.

To add insult to injury, the tanking of the housing market also led to a loss of mortgage brokers, real estate agency offices and a multitude of other real estate professionals. The unemployment and closures of real estate businesses also caused the commercial spaces once filled with these businesses to empty out.

In total, this has left $3.5 trillion in commercial loans with more than $2 trillion in commercial mortgages maturing between now and 2013. The short answer is that it looks pretty grim for the commercial mortgage industry, so even as the residential market seems to be heading toward a recovery, there is a lag in the commercial industry that means it'll take longer for this market to catch up.

Posted by Kristie Lorette at 1:54 PM 0 comments

Labels: commercial mortgage industry, commercial mortgages, commercial mortgages vs. residential mortgages

Friday, September 4, 2009

Your First Car Loan

Financing a new or previously owned car for the first time may seem like a scary experience. It will be less scary if you know what you're doing before you step foot in the financing office of the dealership.

Know your credit score

If you don't already know your credit score, then find it out by ordering it from one or all three of the credit agencies (Experian, TransUnion and Equifax). Your credit score plays a huge role in whether or not you get car loan approval and it's also a factor in the interest rate and term (length) of the loan you can get. Shoppers with higher credit scores (usually above 700) get lower interest rates than those with lower credit scores.

Comparison Shop

As you would with any major financial purchase, you should shop and compare at least three auto lenders before going with one of them. Interest rates can vary from lender to lender and you want to make sure that you're getting the best deal possible--no matter what your credit score is.

Shop with approval in hand

It's possible to get pre-approved for an auto loan before you've even started shopping for the car. It's also a good idea because it gives you a price range to stick with. This prevents a crafty car salesman (or woman) from up-selling you into a more expensive vehicle than you may not be able to afford. Pre-approval also cuts down the time you have to spend at the car dealership while the finance department pulls credit and tries to put together an auto loan through the dealership.

It can also give you some negotiating power. Some dealerships offer cash rebates or low interest rate financing. If you already have low interest rate financing setup for your auto loan then have the opportunity to take advantage of the rebate--and you'll still get a low interest rate from the original lender.

Shopping for a car loan isn't brain surgery by any means, but if you're prepared you are more likely to come out ahead in the deal.

Posted by Kristie Lorette at 1:42 PM 0 comments

Labels: car loan advice shopping for a car loan, first auto loan, first auto loan advice, first car loan, shopping for an auto loan

Thursday, September 3, 2009

Your Money: Reverse Mortgages

Posted by Kristie Lorette at 6:19 PM 0 comments

Labels: reverse mortgages

Tuesday, September 1, 2009

Wednesday, August 26, 2009

Adjustable Rate Mortgages – Good or Bad?

Does the term adjustable rate mortgage or the thought of having one send you into a panic? While an adjustable rate mortgages (ARM) is not right for everyone or for every situation, there are advantages to having an ARM over a fixed rate mortgage.

First, adjustable rate mortgages tend to have lower interest rates than fixed rate mortgages. Depending on when the ARM is due to adjust and what interest rates are expected to do (increase or decrease), an adjustable rate mortgage can cost a borrower a lot less in the long run.

A scenario where it may be beneficial to have an ARM is when you know that your time living in the home or having the mortgage will be short. If you can deal with possible adjustments in your monthly mortgage payment and only plan on living in the home for a short period, it may save you thousands of dollars to obtain an ARM over a fixed rate. For example, if you know that you will only be living in the home for 3 years, then a 3/1 ARM may work for you. This is a fixed-to-adjustable rate mortgage that has a fixed interest rate for the first 3 years of the mortgage. After the third year, the interest rate adjusts every year.

If you'll only be in the home three years, it doesn't matter what the interest rate does on the fourth year because you'll no longer be living there. During the three year period, however, you can enjoy a lower interest rate than a fixed rate mortgage, which means less in monthly mortgage payments.

Another situation where ARMS are more beneficial is when interest rates are expected to drop. For example, Mr. Smith purchases a home using an adjustable rate mortgage that adjusts every six months. He did this because he expects interest rates to drop over the next couple of years. It is a gamble because interest rates can go either way, but if you can emotionally and financially handle fluctuations, ARMs can be more cost effective ways to finance a home.

Posted by Kristie Lorette at 4:56 PM 0 comments

Labels: adjustable rate mortgages, ARMs, is an adjustable rate mortgage good or bad?

Tuesday, August 25, 2009

Mortgage Fraud Task Force

At least eight states have woken up and seen what is going on the arena of mortgage fraud. The Attorney General (AG) offices for the states of Arizona, Colorado, Illinois, Nevada, North Carolina, Massachusetts, Missouri and Ohio have announced that they are forming a mortgage fraud task force.

The task force will be tackling issues such as equity skimming, bogus foreclosure rescue, straw purchases and unethical lending practices.

The leader of the task force is the Washington Attorney General Rob McKenna. Representatives from the Department Justice, federal treasury, Department of Housing and Urban Development and (HUD) Federal Trade Commission (FTC) will also be involved in combating mortgage fraud as part of the task force duties.

Posted by Kristie Lorette at 12:34 PM 0 comments

Labels: how to avoid becoming a victim of mortgage fraud, mortgage fraud task force, stop mortgage fraud

Friday, August 21, 2009

Cash for Clunkers Comes to a Screeching Halt

The Cash for Clunkers program was introduced a few short months ago and the total amount devoted to the stimulus program was $1 million. The program was to run until November 1 or when the $1 million set aside in rebates was reached, whichever of the two came first.

As of Monday, August 24, 2009 the Cash for Clunkers program will come to a halt, so car buyers have one last weekend to get to their favorite dealership and trade-in their clunker for a brand new car--at least if you want to take advantage of the $4,500 rebate.

Posted by Kristie Lorette at 6:32 AM 0 comments

Labels: cash for clunkers comes to an end, cash for clunkers program

Wednesday, August 19, 2009

5 Reasons Why Seniors Get Reverse Mortgages

If you're nearing the age of retirement, usually 62 years old, and you have equity built up in your home, you may have looked into doing a reverse mortgage. You should do your homework and really research what a reverse mortgage is all about and how it may or may not benefit you to have one before making any final decisions. Here are the top five reasons that seniors obtain a reverse mortgage. Do you see your self in any of these scenarios?

1. Retirement Lifestyle

Homeowners that have lived in their home for the last thirty years or so have either paid off their mortgage completely or have been making monthly payments that is bringing them to the end of their mortgage journey. Depending on how much your mortgage is or was, this may be the biggest expense you pay out on a monthly basis. As you reach retirement, you may be starting to worry about how your fixed income will weather in continuing to cover all of your fixed monthly living expenses such as housing, medical and insurance. Even if you have income from retirement accounts, pension plans, social security or other sources, a reverse mortgage can allow a retiree to increase their fixed income amount. In essence, the added income a reverse mortgage provides can establish a higher quality of life--a nicer retirement lifestyle--than if they didn't have the reverse mortgage payment coming in every month.

2. Pays for medical expenses

Medical expenses are a fact of life, but this fact seems to increase as you get older. And since the cost of health care isn't getting any cheaper, rising costs make it harder for seniors to pay for health care on a fixed income. It forces some to have to choose between buying food and paying for their medication on a regular basis. With a reverse mortgage adding to monthly income, it can help you to cover all of your expenses and not have to choose between medicine and some other necessity.

3. Changes to home